Phone calls are the primary means of bond trading in India - Harmoney aims to change that by digitizing India’s bond markets.

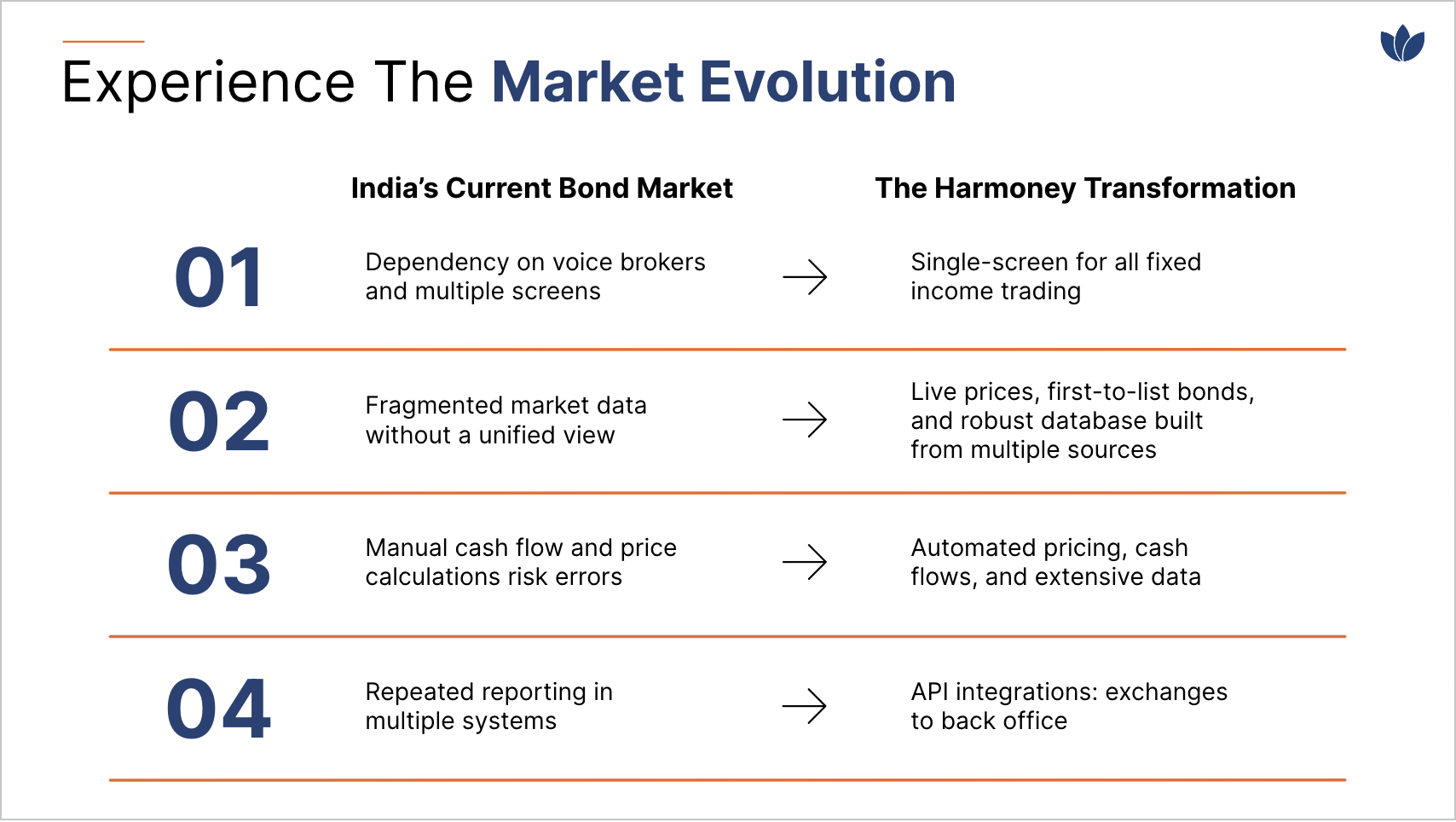

Traditional methods of bond trading rely heavily on manual processes and phone calls. This setup often leads to challenges for traders, including but not limited to:

- Dependency on voice brokers to execute trades

- Scattered market data

- Manual calculations of cash flow and price

- Meeting regulatory requirements across multiple reporting systems

These inefficiencies necessitated a change.

With a mission to transform bond trading in India, Harmoney began its journey in 2021 to digitize the bond market for a seamless, efficient electronic trading experience.

Reshaping Indian Bond Markets

In 2022, the first iteration of the Harmoney trading platform was launched, and it has been continuously refined over the past 1.5 years. Here are three key strengths that set it apart:

- Accessibility: Expanding Market Reach

Harmoney currently hosts 150+ active participants. Over 80% of the trades on the platform involve counterparties who have never traded with each other before. By connecting retail and institutional participants in one place, the platform provides a wider reach, creating opportunities and expanding networks in unparalleled ways. - Efficiency: Streamlining Transactions

Harmoney consolidates all the necessary data onto a single screen, helping investors make informed decisions. The seamless integration with a straight-through-processing (STP) with the exchanges and automated deal pricing and ticketing saves 15 minutes per trade on average. The STP system enables automated financial transactions from start to finish without manual intervention, streamlining operations and reducing the risk of human error. - Transparency: Aggregating the Market

Harmoney acts as an agent, not a principal. The platform functions as a market aggregator, with real-time quotes from 150+ market participants to facilitate decision-making and direct negotiations with the counterparty. The daily bid volume has jumped from 1 crore to over 250 crore, resulting in higher liquidity and transparency for market participants.

The Way Ahead

While electronic trading is advancing in the U.S., the Indian bond market is just beginning its journey. Harmoney is at the forefront, addressing traditional trading limitations and paving the way for a more efficient, transparent market.

Get in touch with your Relationship Manager or contact us for any questions or follow-ups at sales@harmoney.in