Harmoney recently introduced the market depth feature to help our clients get more market information and improve their trading activity.

One of our goals at Harmoney is to make bond trading more efficient and help participants get more price transparency. Market depth is one of the steps that we have taken in this direction.

Market Depth provides insights into the liquidity of a bond, indicating the ease with which a bond can be bought or sold without causing a significant impact on its price. Typically, the more buy and sell quotes that exist, the greater the depth of the market will be, provided that those quotes are dispersed fairly and evenly around the current market rate of that security.

How it benefits you?

Market depth is useful for getting pre-trade information before making or executing a trading decision. It helps you make informed decisions and understand the overall market.

- View market activity without revealing your interest - This allows you to decide if you want to initiate a trade in a bond before placing a bid/offer.

- Assess price movements and get a better sense of levels - This can potentially help you improve your execution price.

- See available liquidity - How much total quantum is available for trading in the market.

How it works on Harmoney

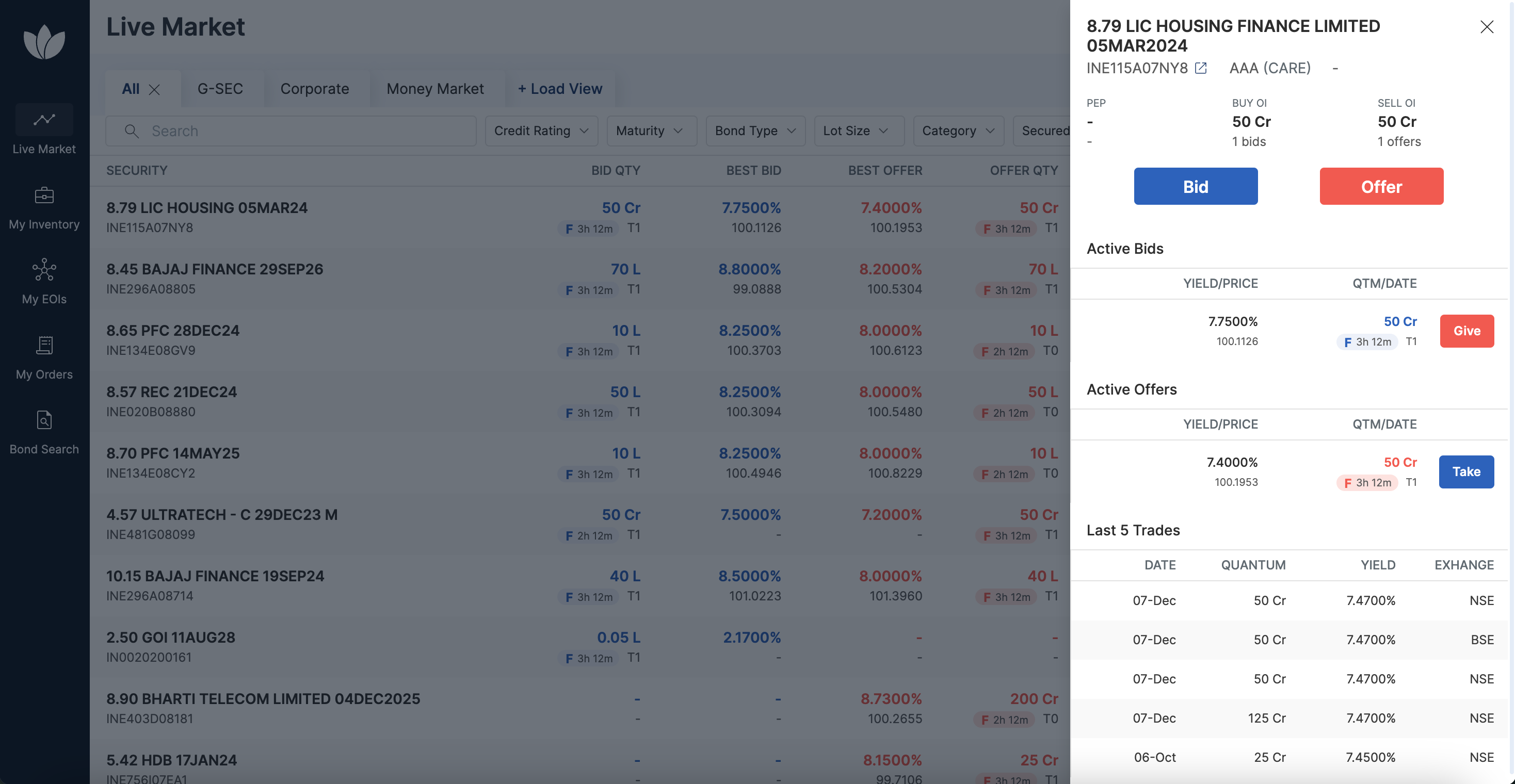

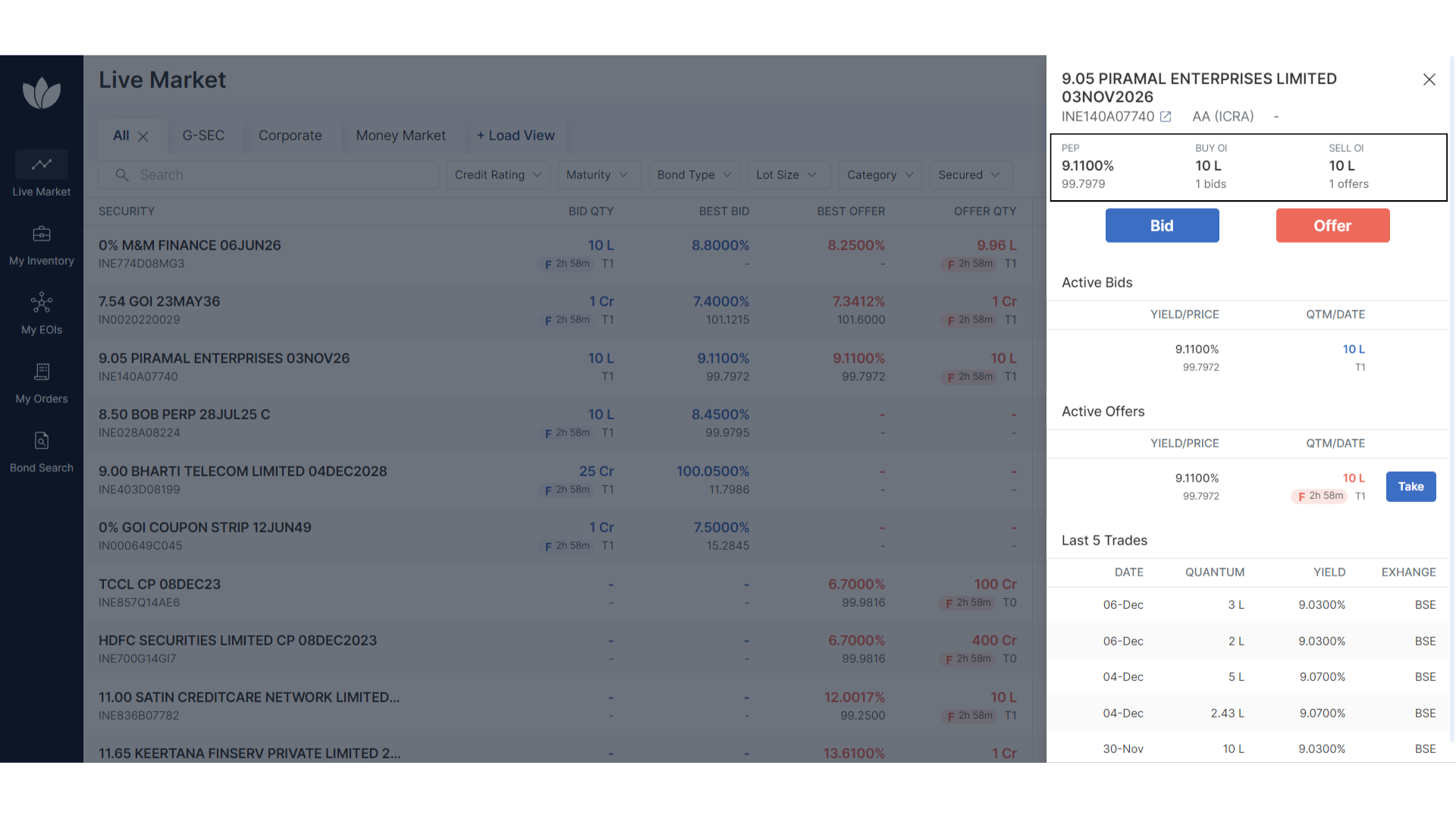

Market depth will show you the market liquidity for a security based on the number of open buy and sell quotes (bids/offers) at various price levels. In addition to the price levels, you will also see the quantum or lot size for each bid/offer and the validity time of that quote.

You also get the last 5 trades for any bond with the traded date, level, quantum, and exchange. This helps you see and better judge the price movement of the security and place precise bids/offers.

Case Study

Market makers can view quotes that are trading outside their bid/offer spread via market depth. This allows market makers to quickly correct prices and bring them back to a normal trading range.

For example, 6.75 Piramal 2031 generally trades between 10.90-11.00% in the current market. If a market maker or any participant sees an offer at 11.10%, they can quickly close that from the market depth without having to place any order.

You can also learn how Market Depth works and know more about DART from our Product Guide.

Get in touch with us for any questions or follow-ups at support@harmoney.in