Weekly Newsletter - 10th June 2024

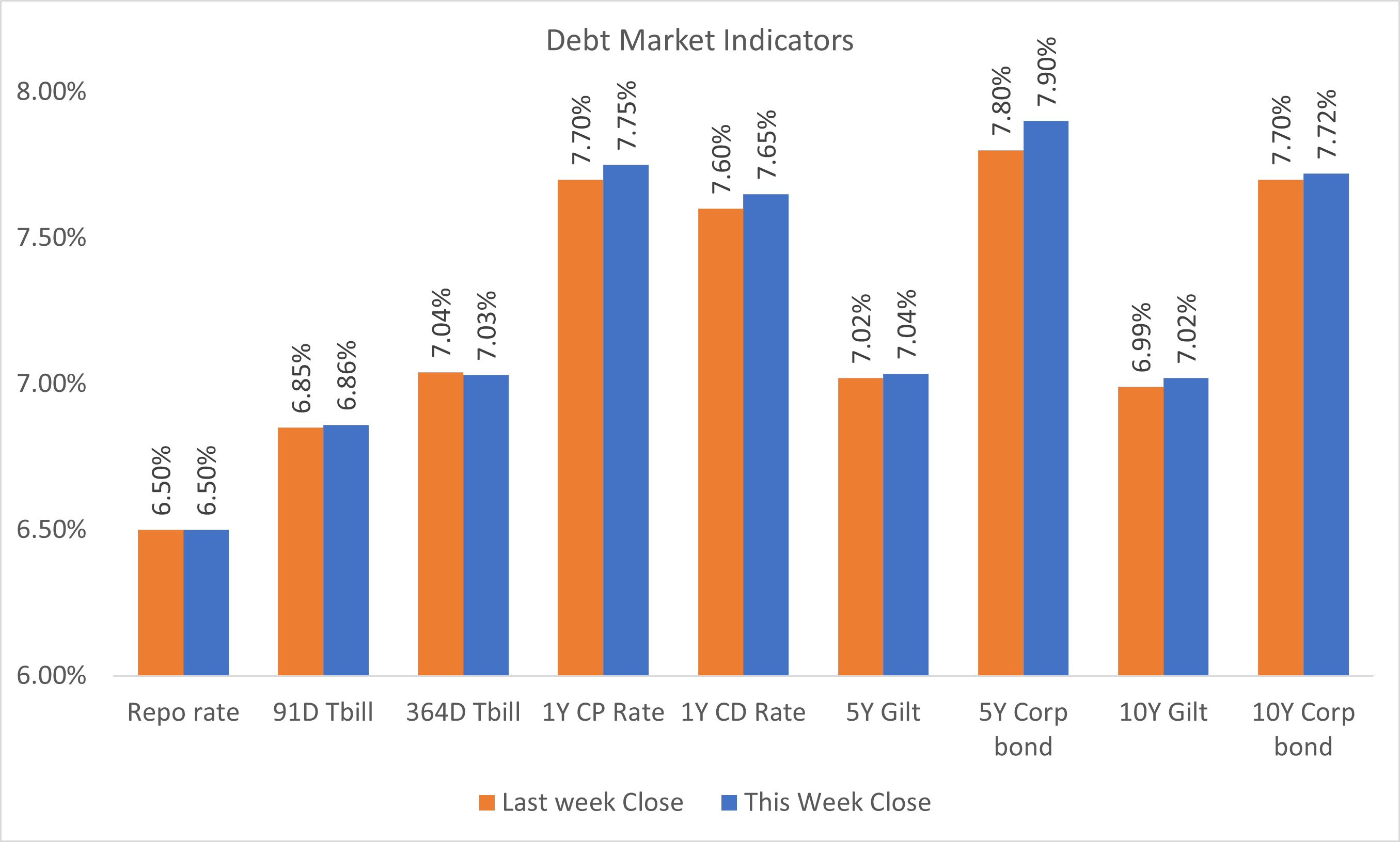

Throughout the eventful week, the Indian 10Y government bond fluctuated within the range of 6.95% to 7.05%. Following the announcement of poll results, the market experienced a sudden reaction, while the RBI's monetary policy remained uneventful. Consequently, the 10Y benchmark settled at the same level. Going forward, market participants anticipate the Indian 10Y bond to trade within a broader range of 7.00% to 7.20%.

Indian Debt

- The interbank call money rate ended at 6.58%.

- After the general election results were announced, the Indian 10Y yield increased by 3bps, driven by concerns that a coalition government might deviate from fiscal discipline measures.

- The yield of the 10Y benchmark 7.10% 2034 bond ended at 7.02%.

Market Trends

- The Indian Rupee depreciated by 19 paise against the US dollar this week, coinciding with a net outflow of nearly INR 18,000 crore from the Indian equity market. This decline is attributed to the uncertainty surrounding the continuity of existing economic policies under the new incoming government.

- The yield on the US 10Y Treasury note hovered around 4.30%, down by 25 bps this week, as new economic data indicated that investors anticipate a rate cut as early as September.

- Oil prices are set to decline for the third consecutive week due to concerns about a potential supply surplus following the latest OPEC+ decision. While OPEC+ agreed to extend most supply cuts into 2025, they also announced plans to gradually phase out some voluntary output cuts from eight member countries starting in October.

General News

- Indian Central Bank maintained the status quo keeping the repo rate and stance unchanged.

- The Indian general election results were surprising, but the NDA has successfully formed a coalition government.

| Global Markets | Close | Last week close |

|---|---|---|

| US 10Y | 4.30 | 4.55 |

| USD/INR | 83.47 | 83.28 |

| Brent | 80.00 | 81.75 |

Primary Issues

| ISIN | Security Name | Ratings | Tenor | Yield |

|---|---|---|---|---|

| INE202E08201 | IREDA | ICRA AAA | 25-June-34 | 7.5% |

| INE725H08196 | Tata Projects | CRISIL AA | 28-Apr-27 | 8.25% |

| INE0CU607015 | GMR POWER AND URBAN INFRA | INFOMERICS BB- | 11-June-25 | 10.93% |

Insights from our Team

Bonds with the highest number of quotes on our Platform:

| ISIN | Security Name | Total Bids | Total Offers |

|---|---|---|---|

| INE540P07434 | 9.70 UPPCL 22MAR32 | 6 | 27 |

| INE557F08FY4 | 7.59 NATIONAL HSG BANK 14JUL27 | 14 | 18 |

| INE861G08043 | 8.95 FOOD CORP OF INDIA 01MAR29 | 10 | 12 |

| INE039A09MD2 | 9.75 IFCI LIMITED 16JUL30 | 9 | 10 |

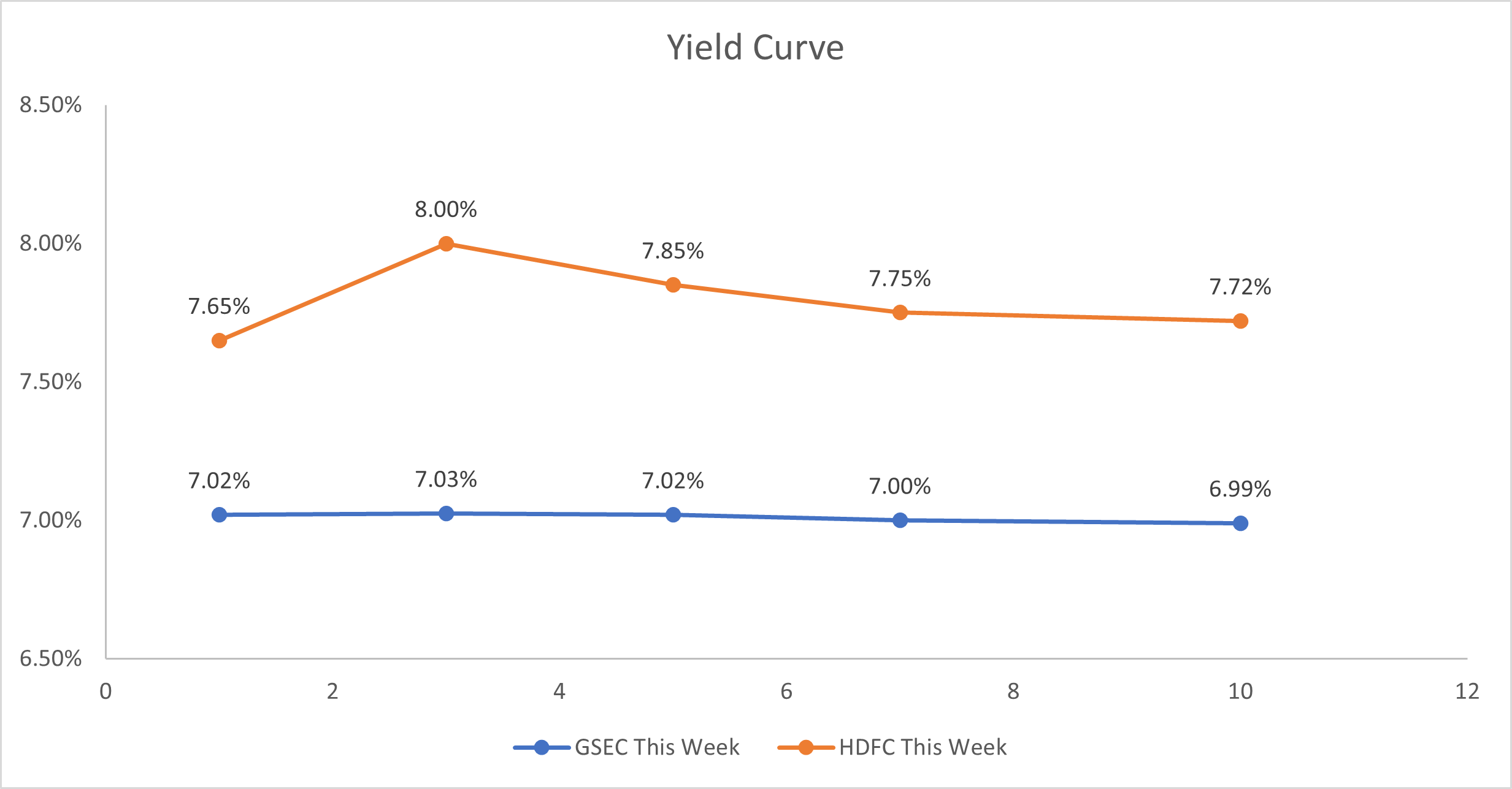

Yield Curve:

Most actively traded bonds in the Standard Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE557F08FY4 | 7.59 NHB 14JUL27 | 1835 | 7.59 |

| INE296A07SV1 | 7.82 BAJAJ FIN 08FEB27 C | 1280 | 7.94 |

| INE153A08105 | 8.00 MTNL 15NOV32 | 1102 | 7.81 |

| INE261F08DI1 | 5.23 NABARD 31JAN25 | 820 | 7.66 |

Most actively traded bonds in the Odd Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE572J07703 | 9.81 SPANDANA 02APR26 | 24.78 | 11.00 |

| INE540P07434 | 9.70 UPPCL 22MAR32 | 14.7 | 8.81 |

| INE0GXL07039 | 11.85 NAVITECHN 17MAY26 | 14.51 | 11.92 |

| INE860H07IW8 | 8.16 ABFL 14FEB29 | 13.2 | 8.15 |

Maturity-based traded volume:

| Maturity | Volume(in Cr) |

|---|---|

| 1Y | 5100 |

| 3Y | 4466 |

| 5Y | 3580 |

| 7Y | 295 |

| 10Y | 2215 |

Outlier Trades:

| ISIN | Security Name | YTM Jun 6(%) |

YTM Jun 5(%) |

Deviation(%) |

|---|---|---|---|---|

| INE090W07683 | 10.76 LENDINGKARTFIN 10MAY26 | 12.36 | 13.2 | -0.84 |

| INE0NES07105 | 11.40 KEERTANA 10MAY26 | 12.7 | 13.44 | -0.75 |

| INE01HV07452 | 9.90 VIVRITI 11MAR26 | 10.86 | 10.60 | 0.26 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in