Weekly Newsletter - 10th May 2024

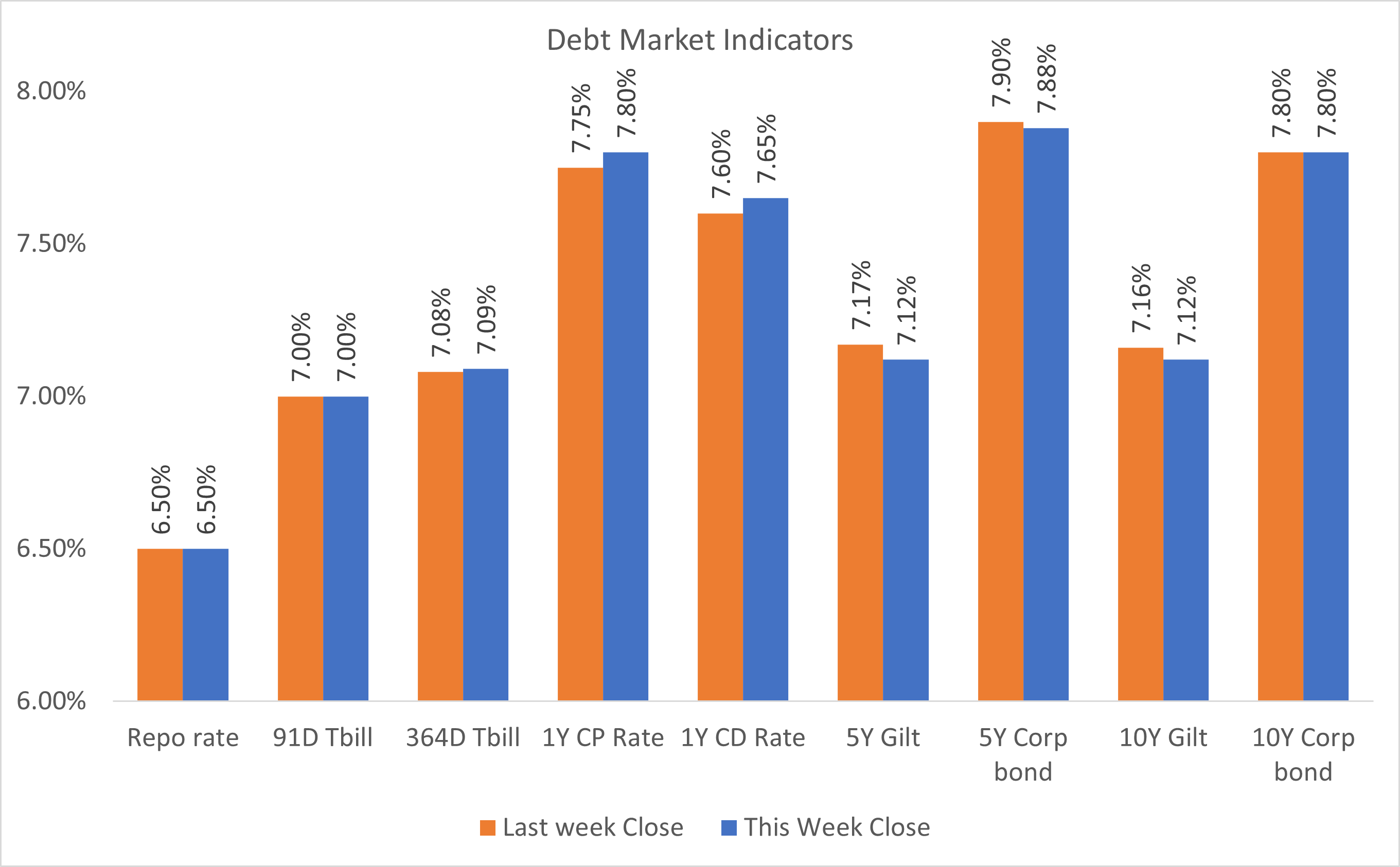

The Indian 10Y government bond convincingly breached the 7.15% threshold on the downside, aided by a fall in the US 10Y Treasury note. Going ahead, it is anticipated that the Indian 10Y yield will trade within the range of 7.10% to 7.15%. The upcoming Indian CPI number for April 2024 will be the next big trigger for the market to determine its future course.

Indian Debt

- The interbank call money rate ended at 6.78%.

- Indian 10Y bond yield decreased by 4bps over the week, aligning with movements in the US 10Y Treasury note.

- The yield of the 10-year benchmark 7.18% 2033 bond ended at 7.12%.

Market Trends

- Indian rupee depreciated by 12 paise against the US dollar as the Indian equity market witnessed a net outflow of 22430crs. It is speculated that the RBI may have taken measures to stabilize the depreciating INR.

- The yield on the US 10Y Treasury note initially rose but later retreated below 4.5%, following a surge in initial jobless claims to their highest levels in 8 months. This development provides additional indications of a weakening labor market, potentially setting the stage for a Federal Reserve interest rate reduction.

- Brent crude futures surpassed the $84 per barrel mark, poised for a significant weekly gain driven by an optimistic global demand forecast and continued tensions in the Middle East, which have buoyed oil prices.

General News

- Indian CPI numbers for April 2024 will be published on 13 May 2024

- The market will be keen to hear Fed Chair Powell's speech on 14 May 2024

| Global Markets | Close | Last week close |

|---|---|---|

| US 10Y | 4.46 | 4.58 |

| USD/INR | 83.50 | 83.38 |

| Brent | 84.50 | 84.50 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| SBFC Finance | IND AA- | 36 months | 200+0 | 10-May-24 | BSE |

| AK Capital | CARE AA- | 36 months | 35+35 | 10-May-24 | NSE |

Insights from our Team Experts

Bonds with the highest number of quotes on our Platform:

| ISIN | Security Name | Total Bids | Total Offers |

|---|---|---|---|

| INE741K07579 | 9.70 CREDITACCESS GRAMEEN 07SEP28 | 11 | 13 |

| INE053F07835 | 7.28 IRFC 21DEC30 | 6 | 7 |

| INE540P07400 | 9.70 UPPCL 30MAR29 | 6 | 14 |

| INE950O08022 | 9.25 MAHINDRA RURAL HSG FIN 13OCT25 | 5 | 17 |

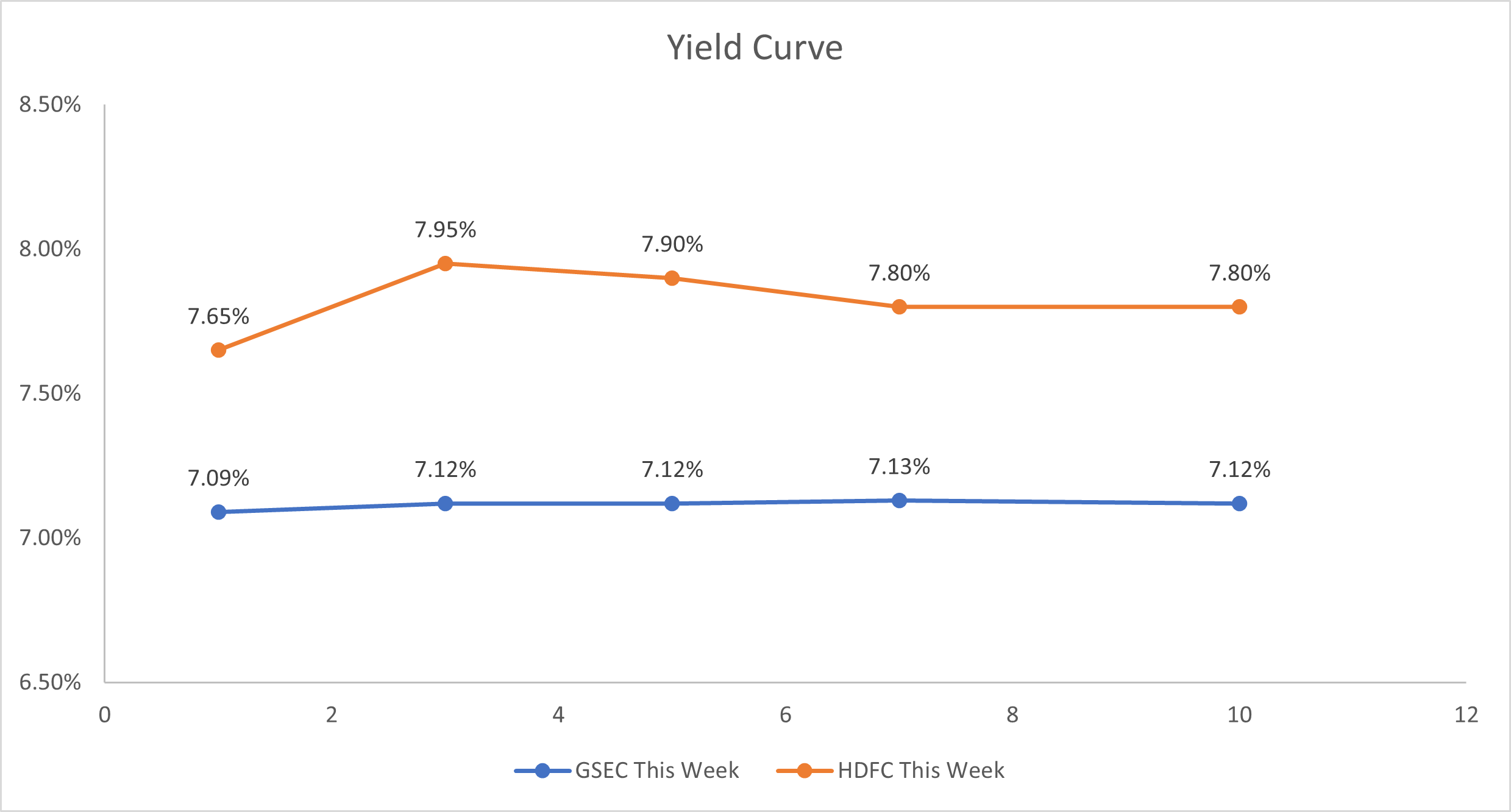

Yield Curve:

Most actively traded bonds in the Standard Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE040A08930 | 7.65 HDFC BANK 25MAY33 | 1595 | 7.85 |

| INE296A07SL2 | 7.75 BAJAJ FINANCE 16MAY33 | 1050 | 8.02 |

| INE261F08EG3 | 7.68 NABARD 30APR29 | 900 | 7.68 |

| INE296A07SX7 | 0.00 BAJAJ FINANCE 10MAY27 | 805 | 8.16 |

Most actively traded bonds in the Odd Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE515Q08267 | 12.00 AFPL 24JAN30 | 38 | 12.24 |

| INE572J07679 | 10.75 SPANDANA 03APR26 | 29 | 11.81 |

| INE07HK07726 | 9.84 KRAZYBEE SERVICES 26JUL25 | 24 | 11.95 |

| INE540P07400 | 9.70 UPPCL 30MAR29 | 20 | 8.94 |

Maturity-based traded volume:

| Maturity | Volume(in Cr) |

|---|---|

| 1Y | 7874 |

| 3Y | 2886 |

| 5Y | 2740 |

| 7Y | 411 |

| 10Y | 835 |

Outlier Trades:

| ISIN | Security Name | YTM May 9(%) |

YTM May 8(%) |

Deviation(%) |

|---|---|---|---|---|

| INE0M2307057 | 9.62 AP BEV 31MAY27 | 8.88 | 9.44 | -0.56 |

| INE516Y07477 | 8.80 PIRAMAL CAPITAL 30DEC24 | 9.11 | 8.81 | 0.3 |

| INE540P07400 | 9.70 UPPCL 30MAR29 | 8.99 | 8.74 | 0.25 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in