Weekly Newsletter - 12th Apr 2024

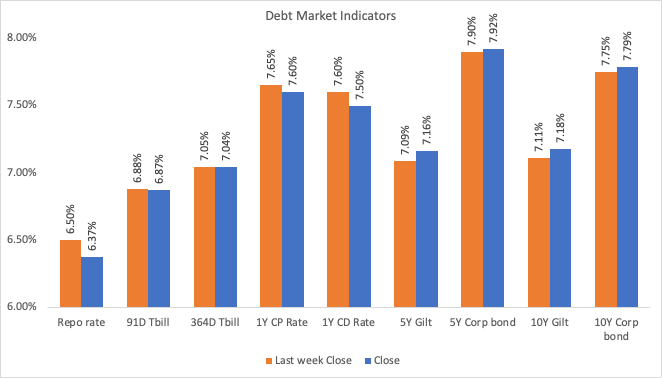

The bonds market opened on a weak note, following a surge in US Treasury yields. Throughout the week, the persistent rise in crude oil prices continued to exert pressure on bonds. Additionally, bonds traded within a narrow price range until the outcome of the April 2024 MPC meeting. On Friday, market sentiment remained subdued as the MPC outcome did not suggest any imminent rate cuts. Consequently, the 10Y benchmark 7.18% 2033 closed at 7.18%, up from 7.11% at the previous week's close.

Indian Debt

- The interbank call money rate ended at 6.55%

- The Indian Government 10Y bond moved in the range of 7.00% to 7.15% during the week, eventually closing at 7.13% as the rising Brent crude price and rise in US 10Y are keeping the market cautious

- The yield of the 10-year benchmark 7.18% 2033 bond ended at 7.18%

Market Trends

- Indian rupee against the US dollar remained flat during the week.

- The US 10-year Treasury yield fluctuated between 4.35% and 4.60% throughout the week before settling at 4.58%. Mixed economic data and less-than-expected rate cuts for the year 2024 by some of the Fed members can be attributed to the rise in yield.

- OPEC+ decision to keep the output the same till June 24 and continuing geo-political tension has pushed the price of Brent above 90$ per barrel.

| Indian Indices | Close | Last week Close |

|---|---|---|

| Sensex | 75,038 | 74,150 |

| Nifty | 22,754 | 22,489 |

General News

- March 2024 saw a higher-than-anticipated rise in US inflation, dashing hopes for a potential interest rate cut from the US Fed in June. The CPI surged to 3.5% YoY, marking the highest gain in six months.

- Recent tensions in the Middle East and supply disruptions have led to a rally in oil prices, raising the possibility of the global benchmark reaching the hundred-dollar mark.

| Global Markets | Close | Last week close |

|---|---|---|

| DJIA | 38,459 | 38,597 |

| NASDAQ | 16,442 | 16,049 |

| US 10Y | 4.58 | 4.33 |

| USD/INR | 83.35 | 83.40 |

| Brent | 89.74 | 91.00 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| CIFCL | ICRA AA+ | 60 months | 500+500 | 10-Apr-24 | BSE |

| Rural Electrification | Crisil AAA | 37 months | 150+500 | 10-Apr-24 | BSE |

Top Traded Bonds

The following are the most actively traded bonds on the Standard Market from 8th Apr to 12th Apr:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE261F08EG3 | 7.68 NABARD 30APR29 | 850.00 | 7.65 |

| INE556F08KP4 | 7.68 SIDBI 10AUG27 | 600.00 | 7.69 |

| INE134E08MO2 | 7.37 PFC 22MAY26 | 300.00 | 7.63 |

| INE261F08DO9 | 7.40 NABARD 30JAN26 | 300.00 | 7.75 |

The following are the top-traded odd lot bonds from 8th Apr to 12th Apr:

| ISIN | Security Name | Volume (Cr) | Avg. yield% |

|---|---|---|---|

| INE027E07BY2 | 0% LTFL 15SEP25 | 12.60 | 8.35 |

| INE01YL07268 | 11.50 EARLYSALARY 06OCT25 | 11.91 | 11.69 |

| INE0M2307057 | 9.62 AP BEV 31MAY27 | 9.20 | 9.19 |

| INE062A08215 | 8.75 SBI PERP 30AUG24 C | 8.10 | 8.29 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in