Weekly Newsletter - 17th May 2024

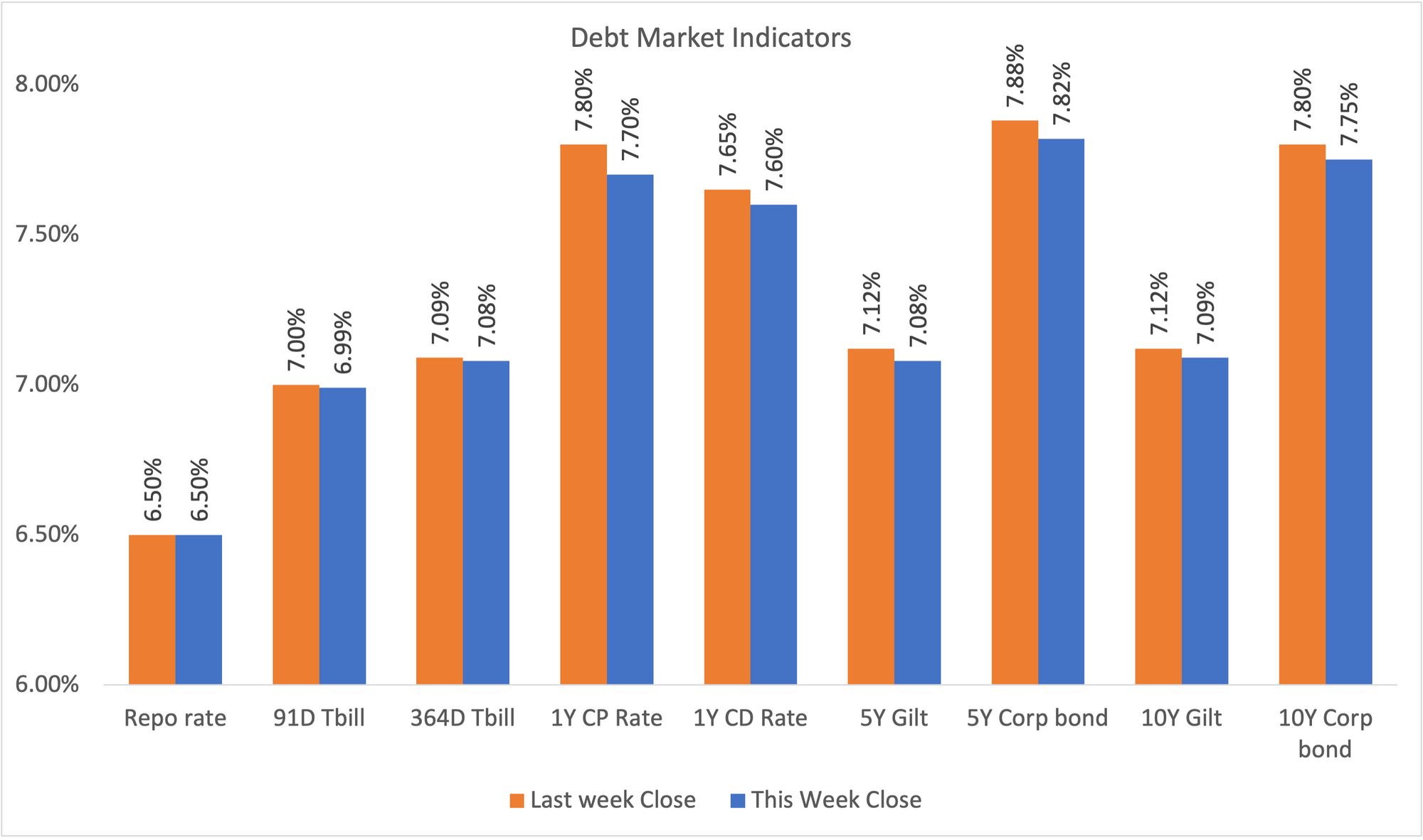

The Indian 10Y government bond yield fluctuated between 7.05% and 7.15% during the week. A decline in the US 10Y Treasury note brought the Indian 10Y yield down to 7.05%, prompting some market participants to book profits at this level. With Brent crude prices trading within a narrow range and the US 10Y yield easing from recent highs, the Indian 10Y yield is expected to remain in the 7.05% to 7.15% range.

Indian Debt

- The interbank call money rate ended at 6.77%.

- The Indian 10Y bond yield closed 3bps lower than the previous week's close, due to inflation numbers meeting expectations and being further supported by a decline in the US 10Y yield.

- The yield of the 10Y benchmark 7.18% 2033 bond ended at 7.09%.

Market Trends

- Indian rupee appreciated marginally against the US dollar as the lower-than-expected inflation number weakened the US dollar index.

- The yield on the US 10Y Treasury note decreased by 10bps during the week as a cooldown in inflation raised the expectation for a rate cut.

- Brent crude firmed north of $83 per barrel underpinned by recent declines in US crude oil inventories and growing optimism that the US Federal Reserve will cut interest rates this year.

General News

- Indian CPI number for April 2024 was recorded at 4.83%

- US CPI number for April 2024 was recorded at 3.40%

| Global Markets | Close | Last week close |

|---|---|---|

| US 10Y | 4.37 | 4.46 |

| USD/INR | 83.47 | 83.50 |

| Brent | 83.50 | 84.50 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| NABARD | ICRA AAA | 40 months | 200+300 | 17-May-24 | NSE |

| Tata Capital | CRISIL AAA | 58 months | 250+166 | 17-May-24 | NSE |

Insights from our Team Experts

Bonds with the highest number of quotes on our Platform:

| ISIN | Security Name | Total Bids | Total Offers |

|---|---|---|---|

| INE540P07400 | 9.70 UPPCL 30MAR29 | 3 | 21 |

| INE053F07835 | 9.00 SHRIRAM TRANSPORT FIN 28MAR28 | 10 | 17 |

| INE818W08123 | 11.00 ESAF SMALL FINANCE BANK 20APR30 | 2 | 21 |

| INE516Y07444 | 6.75 PIRAMAL CAPITAL & HSG FIN 26SEP31 | 2 | 19 |

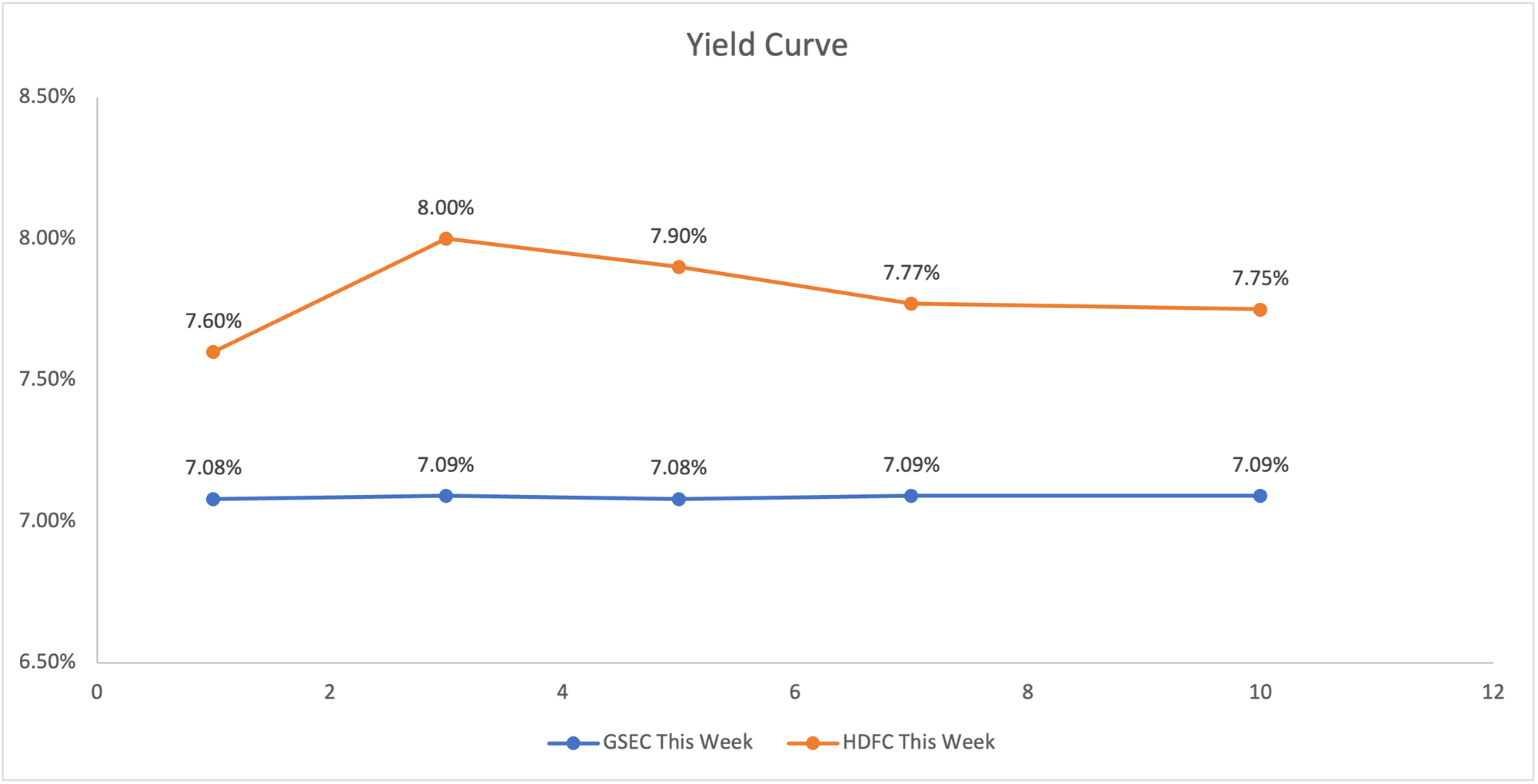

Yield Curve:

Most actively traded bonds in the Standard Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE040A08922 | 7.80 HDFC BANK 02JUN25 | 2600 | 8.01 |

| INE0VB407010 | 10.00 VEDANTA SEMICONDUCTORS 14MAY26 | 1484 | 12.22 |

| INE296A07SV1 | 0.00 BAJAJ FINANCE 31JAN34 | 1425 | 7.97 |

| INE261F08EH1 | 7.62 NABARD 10MAY29 | 1065 | 7.66 |

Most actively traded bonds in the Odd Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE00MX08029 | 13.75 SVATANTRA MICROFIN 31MAR26 | 32 | 9.60 |

| INE572J07695 | 10.75 SPANDANA 21DEC26 | 15 | 11.46 |

| INE906B07EI0 | 7.35 NHAI 11JAN31 | 14 | 5.22 |

| INE06E507199 | 10.47 HELLAINFRA 26SEP25 | 13 | 13.51 |

Maturity-based traded volume:

| Maturity | Volume(in Cr) |

|---|---|

| 1Y | 9448 |

| 3Y | 4903 |

| 5Y | 3202 |

| 7Y | 671 |

| 10Y | 4241 |

Outlier Trades:

| ISIN | Security Name | YTM May 16(%) |

YTM May 15(%) |

Deviation(%) |

|---|---|---|---|---|

| INE06E507199 | 10.47 HELLAINFRA 26SEP25 | 16.07 | 13.07 | 3.00 |

| INE906B07EI0 | 7.35 NHAI 11JAN31 | 5.10 | 5.35 | -0.25 |

| INE572J07679 | 10.75 SPANDANA 03APR26 | 11.93 | 11.53 | 0.39 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in