Weekly Newsletter - 19th Apr 2024

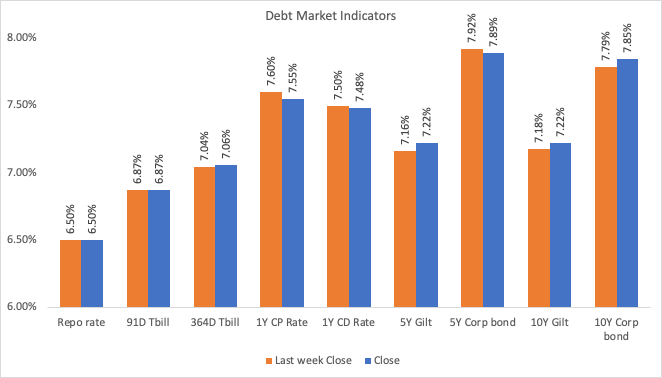

Heightened US 10Y yields and global geopolitical instability have propelled Indian 10Y yields above 7.20%, reaching a three-month peak. Going forward, market focus will remain on US developments and clarity regarding tensions between Iran and Israel. Any escalation between the two countries will keep the Brent price up, which in turn will affect the Indian 10Y. Market participants believe that the new trading range for the Indian 10Y will be 7.15% to 7.25%.

Indian Debt

- The interbank call money rate ended at 6.60%

- The Indian Government's 10-year bond yield has surged above 7.20%. This increase in yield is linked to the uptick in the US 10-year Treasury yield following hawkish remarks from the Fed chairman. Additionally, ongoing geopolitical tensions are exerting upward pressure on Brent crude prices, contributing to the rise in bond yields.

- The yield of the 10-year benchmark 7.18% 2033 bond ended at 7.22%

Market Trends

- The Indian rupee experienced a week of fluctuation against the US dollar, trading between 83.35 and 83.60. This volatility was attributed to a strengthening dollar index and uncertainties in the geopolitical landscape.

- The yield on the US 10Y Treasury note climbed past the 4.6% mark, nearing the five-month peak of 4.67%, propelled by another set of robust economic indicators that lean towards a more hawkish stance for the Federal Reserve.

- Brent hovered around $90 per barrel after news emerged of significant explosions in Iran, Iraq, and Syria, believed to be Israeli strikes.

| Indian Indices | Close | Last week Close |

|---|---|---|

| Sensex | 72,100 | 75,038 |

| Nifty | 21,870 | 22,754 |

General News

- India's CPI number for the month of March 2024 came out at 4.85%, the lowest in the last 10 months.

- Fed chairman's hawkish comment signals delayed rate cut amid high inflation.

| Global Markets | Close | Last week close |

|---|---|---|

| DJIA | 37,775 | 38,459 |

| NASDAQ | 15,601 | 16,442 |

| US 10Y | 4.55 | 4.58 |

| USD/INR | 83.49 | 83.35 |

| Brent | 88.60 | 89.74 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| ABFL | ICRA AAA | 122 months | 100+400 | 19-Apr-24 | BSE |

| HDB Financial Services | CARE AAA | 13 months | 1500+0 | 19-Apr-24 | BSE |

Top Traded Bonds

The following are the most actively traded bonds on the Standard Market from 15th Apr to 19th Apr:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE403D08116 | 8.70 BHARTITEL 21NOV24 | 690.00 | 8.52 |

| INE557F08FP2 | 7.77 NATIHBK - C 02APR26 M | 425.00 | 7.54 |

| INE020B08EZ2 | 7.45 REC 29APR34 | 425.00 | 7.44 |

| INE238A08492 | 0.00 AXIS BANK 07MAR34 | 420.00 | 7.64 |

The following are the top-traded odd lot bonds from 15th Apr to 19th Apr:

| ISIN | Security Name | Volume (Cr) | Avg. yield% |

|---|---|---|---|

| INE540P07400 | 9.70 UPPCL 30MAR29 | 20.50 | 9.09 |

| INE572J07703 | 9.81 SPANDANA 02APR26 | 20.42 | 11.57 |

| INE321N07335 | 9.55 INCRED 10NOV25 | 15.20 | 10.25 |

| INE515Q08242 | 12.25 ANNAPURNA FINANCE 07SEP29 | 14.74 | 12.05 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in