Weekly Newsletter - 27th May 2024

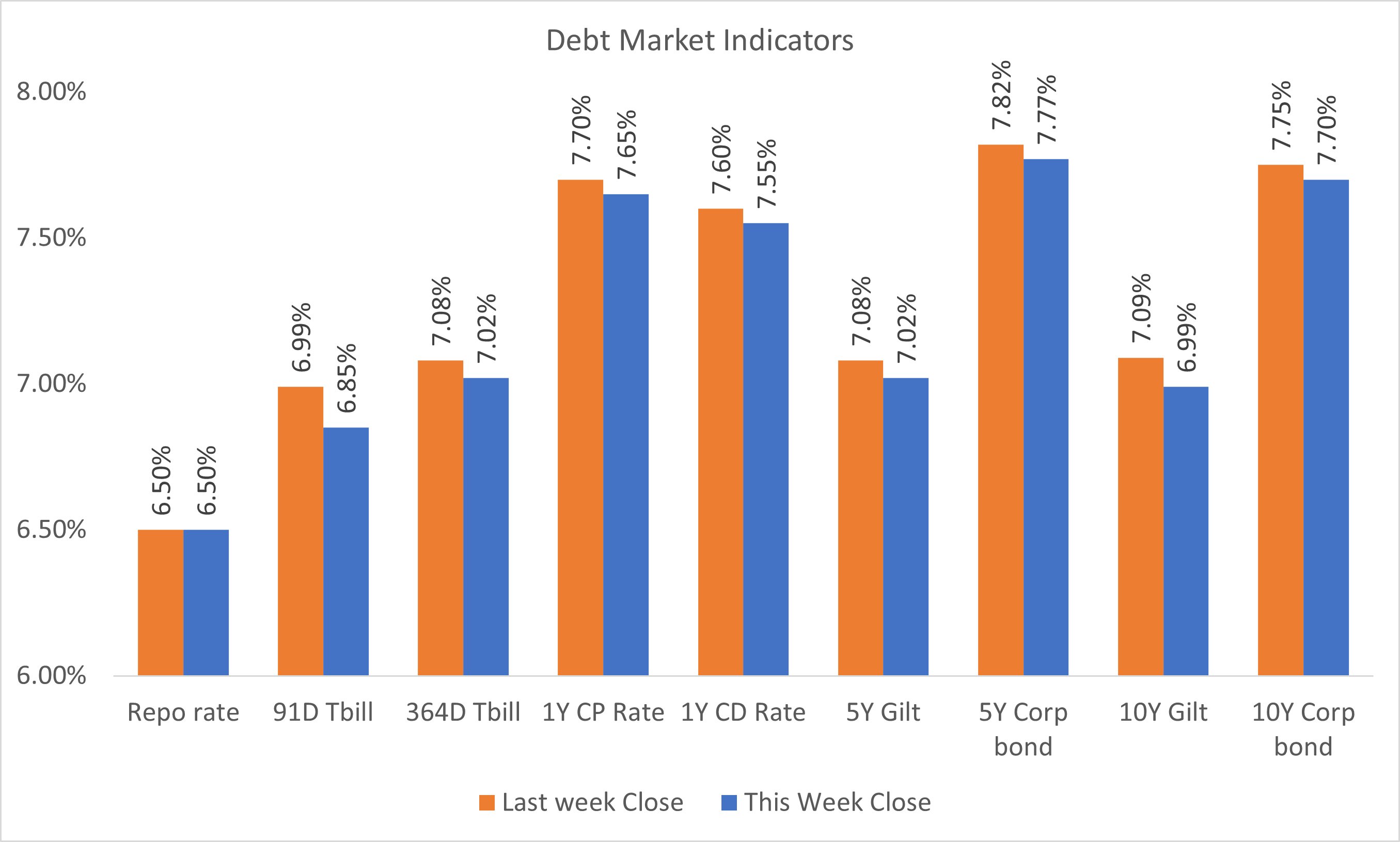

The Indian 10Y government bond yield dropped by 10bps during the week, aided by RBI's dividend bonanza to the central government. FOMC minutes kept the bond market nervous in US and across the globe. Market participants will closely monitor whether the sub-7% level in the Indian 10Y bond yield will sustain or if some profit booking can be witnessed.

Indian Debt

- The interbank call money rate ended at 6.80%.

- The Indian 10Y bond yield moved down by 10bps during the week, backed by RBI's dividend payout of 2.11 lakh crore to the central government for FY24.

- The yield of the 10Y benchmark 7.10% 2034 bond ended at 6.99%.

Market Trends

- The Indian rupee strengthened by 22 paise against the US dollar over the week, driven by a net inflow of ₹3,634 crore from FIIs into the Indian equity market.

- The yield on the US 10Y Treasury note rose toward the 4.47% level, extending its rebound from the one-month low of 4.35% as fresh economic data pointed to a macroeconomic backdrop that favours restrictive monetary policy by the Fed.

- Brent crude steadied north of $81 per barrel on Friday, having declined approximately 3% over the week. This was attributed to the stronger-than-expected US PMI data that reduced the expectations for Federal Reserve interest rate cuts this year.

General News

- RBI approves Rs 2.11 lakh crore dividend payout to govt for FY24.

- Federal Reserve minutes indicate worries over lack of progress on inflation.

| Global Markets | Close | Last week close |

|---|---|---|

| US 10Y | 4.47 | 4.37 |

| USD/INR | 83.25 | 83.47 |

| Brent | 81.50 | 83.50 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| Krazybee Services | CARE A- | 14 months | 50+50 | 24-May-24 | BSE |

| Tata Capital Hsg Fin | CRISIL AAA | 38 months | 250+600 | 24-May-24 | NSE |

Insights from our Team

Bonds with the highest number of quotes on our Platform:

| ISIN | Security Name | Total Bids | Total Offers |

|---|---|---|---|

| INE342T07460 | 10.65 NAVI FINSERV 13MAR27 | 9 | 10 |

| INE148I07NZ9 | 9.48 INDIABULLS HSG FIN 23MAR26 | 12 | 5 |

| INE020B08CJ0 | 7.92 RURAL ELECTRIFICATION 31MAR30 | 7 | 6 |

| INE583D07356 | 10.50 UGRO CAPITAL 08MAR26 | 4 | 7 |

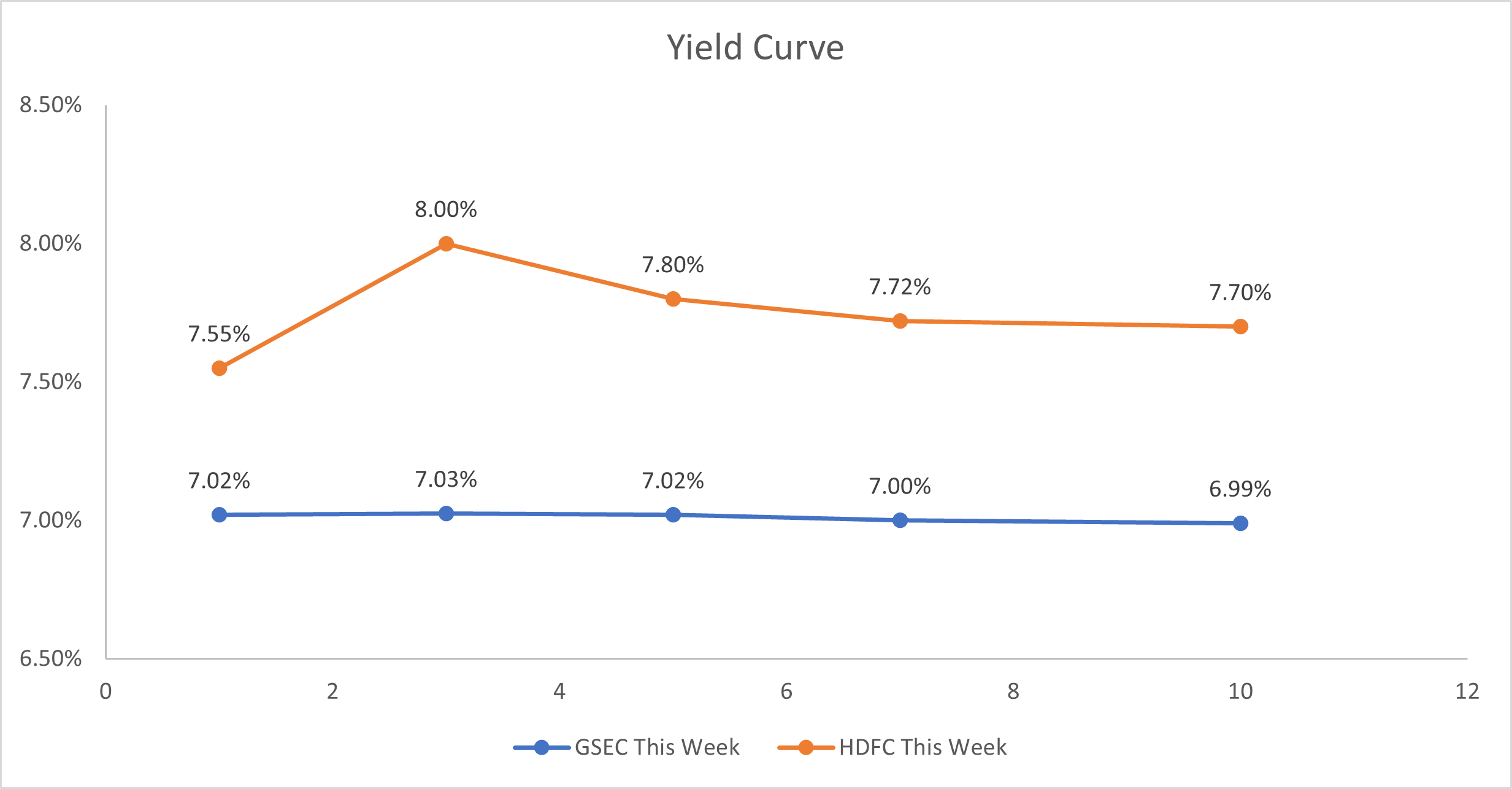

Yield Curve:

Most actively traded bonds in the Standard Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE205A07246 | 12.00 VEDANTA 21JUN25 | 650 | 14.78 |

| INE087A07677 | 11.25 KESORAMINDLTD - C 05FEB34 | 570 | 12.3 |

| INE261F08DF7 | 5.27 NABARD 23JUL24 | 485 | 7.35 |

| INE860H07IY4 | 8.33 ABFL 19MAY27 | 275 | 8.32 |

Most actively traded bonds in the Odd Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE413U07210 | 10.00 IIFLSAMASTA 26NOV26 | 11 | 10.17 |

| INE906B07HG7 | 7.49 NHAI 01AUG29 | 10 | 7.50 |

| INE062A08223 | 8.50 SBI PERP 22NOV24 C | 9.60 | 8.40 |

| INE818F07252 | 8.89 KFC 13MAR30 | 8.40 | 9.21 |

Maturity-based traded volume:

| Maturity | Volume(in Cr) |

|---|---|

| 1Y | 4758 |

| 3Y | 2752 |

| 5Y | 1295 |

| 7Y | 634 |

| 10Y | 2037 |

Outlier Trades:

| ISIN | Security Name | YTM May 22(%) |

YTM May 21(%) |

Deviation(%) |

|---|---|---|---|---|

| INE04VS07305 | 0% OXYZOFINSERV 24JAN25 | 10.47 | 10.72 | -0.26 |

| INE0NES07105 | 11.40 KEERTANA 10MAY26 | 13.34 | 14.02 | -0.68 |

| INE572J07679 | 10.75 SPANDANA 03APR26 | 11.83 | 11.60 | 0.23 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in