Weekly Newsletter - 26th Apr 2024

The Indian 10Y government bond has formed a new trading range of 7.15% to 7.25%, shifting the base upwards from its previous trading range due to global factors. The increase in the US 10-year yield, attributed to heightened inflation concerns, is nudging expectations of a rate cut towards the final quarter of the calendar year. There was notable buying interest observed in the Indian government 10Y bond at the 7.24% level; however, it remains to be seen if the market will respond similarly this time. The upcoming FOMC meeting next week and ongoing geopolitical tensions in the Middle East are pivotal factors that will steer the market's future trajectory.

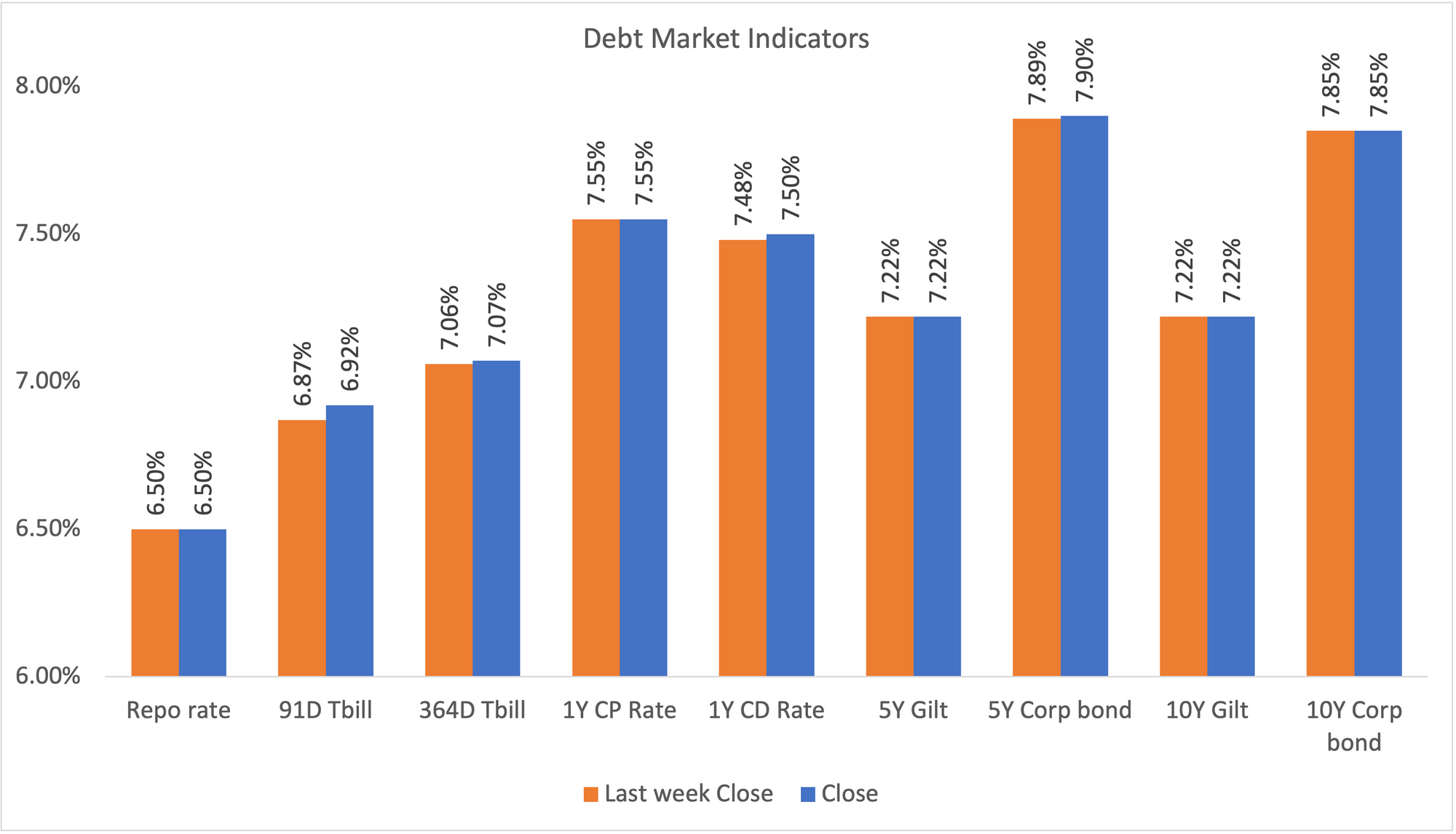

Indian Debt

- The interbank call money rate ended at 6.70%.

- Indian 10Y bond is trading near 7.25%, a level where buying interest can be witnessed. The rise in the Indian 10Y can be attributed to the rising US 10Y.

- The yield of the 10-year benchmark 7.18% 2033 bond ended at 7.22%.

Market Trends

- The Indian rupee appreciated against the US dollar by 15 paise. INR seemed to strengthen due to the softening of the dollar against global peers.

- The US 10Y Treasury note climbed to 4.70% amidst mixed signals from the latest economic indicators. While Q1 GDP data fell short of expectations, PCE data indicated persistent inflationary pressures.

- Brent crude strengthened above 89$ per barrel underpinned by an improving demand outlook and persistent supply risks related to Middle East conflict.

| Indian Indices | Close | Last week Close |

|---|---|---|

| Sensex | 74,375 | 72,100 |

| Nifty | 22,580 | 21,870 |

General News

- RBI unveiled its MPC minutes, highlighting the central bank's emphasis on managing inflation.

- US GDP data for Q1 stood at 1.6% against the expectation of 2.5%.

| Global Markets | Close | Last week close |

|---|---|---|

| DJIA | 38,085 | 37,775 |

| NASDAQ | 15,611 | 15,601 |

| US 10Y | 4.55 | 4.70 |

| USD/INR | 83.34 | 83.49 |

| Brent | 89.40 | 88.60 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| UNO Minda Limited | ICRA AA+ | 36 months | 100+0 | 26-Apr-24 | BSE |

| HDB Financial Services | CARE AAA | 36 months | 60+240 | 26-Apr-24 | BSE |

Top Traded Bonds

The following are the most actively traded bonds on the Standard Market from 22nd Apr to 26th Apr:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE557F08FV0 | 7.78 NATIHBK - C 26APR27 M | 1000 | 7.78 |

| INE115A07PN6 | 6.40 LIC HOUSING 30NOV26 | 950 | 7.97 |

| INE040A08856 | 5.78 HDFC BANK 25NOV25 | 725 | 8.05 |

| INE557F08FW8 | 7.79 NATIHBK - C 06JUL27 M | 650 | 7.79 |

The following are the top-traded odd lot bonds from 22nd Apr to 26th Apr:

| ISIN | Security Name | Volume (Cr) | Avg. yield% |

|---|---|---|---|

| INE572J07703 | 9.81 SPANDANA 02APR26 | 55.08 | 11.52 |

| INE443L08156 | 10.00 BELSTAR 01AUG25 | 43.43 | 9.12 |

| INE348L07167 | 8.60 MAS FINSERV 16JUL25 | 39.63 | 9.54 |

| INE906B07EI0 | 7.35 NHAI 11JAN31 | 29.11 | 5.12 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in