Weekly Newsletter - 3rd June 2024

The Indian 10Y government bond yield remained confined within a tight range of 6.97% to 7.01% throughout the past week, indicating evident profit-taking at the lower boundary. Should the Indian 10Y aim to break below this lower threshold, the market will require new catalysts to initiate its downward trajectory. The upcoming quarterly GDP data and meetings within OPEC+ might serve as potential triggers for the next directional shift.

Indian Debt

- The interbank call money rate ended at 6.74%.

- The Indian 10Y did not witness any significant movement during the week, maintaining a flat trajectory.

- The yield of the 10Y benchmark 7.10% 2034 bond ended at 6.99%.

Market Trends

- Despite net outflows from the Indian equity market by FII's, the Indian rupee maintained stability on a weekly closing basis. This can be attributed to intervention by the central bank and Q1 GDP numbers from the US being lower than expected.

- The yield on the US 10Y Treasury note oscillated between 4.45% and 4.61% throughout the week, closing at 4.55%.

- Brent crude futures declined to approximately $81.5 per barrel, marking their third consecutive session of decrease as ongoing uncertainties regarding demand continued to exert pressure on oil markets.

General News

- India recorded a GDP growth rate of 7.8% for Q4, bringing the overall growth rate for FY24 to 8.2%.

- The US GDP data for Q1 is reported at 1.3%, falling short of the anticipated 1.6%.

| Global Markets | Close | Last week close |

|---|---|---|

| US 10Y | 4.55 | 4.47 |

| USD/INR | 83.28 | 83.25 |

| Brent | 81.75 | 81.50 |

Primary Issues

| ISIN | Security Name | Ratings | Tenor | Yield |

|---|---|---|---|---|

| INE121A07SD9 | Cholamandalam Investment & Fin | ICRA AA+ | 28-May-29 | 8.65% |

| INE498L07038 | L&T Finance | ICRA AAA | 16-Jun-27 | 8.18% |

| INE115A07QR5 | LIC Hsg Fin | CARE AAA | 14-Jul-27 | 7.68% |

| INE213W07285 | SMFG INDIA HOME FIN | CRISIL AAA | 28-May-27 | 8.25% |

| INE020B08FD6 | RURAL ELECTRIFICATION CORP | CRISIL AAA | 31-May-29 | 7.58% |

Insights from our Team

Bonds with the highest number of quotes on our Platform:

| ISIN | Security Name | Total Bids | Total Offers |

|---|---|---|---|

| INE540P07434 | 9.70 UPPCL 22MAR32 | 6 | 22 |

| INE836B07857 | 10.40 SATIN CREDITCARE NETWORK 30APR27 | 3 | 12 |

| INE540P07400 | 9.70 UPPCL 30MAR29 | 3 | 12 |

| INE787H07156 | 7.40 IIFCL 22JAN33 | 1 | 13 |

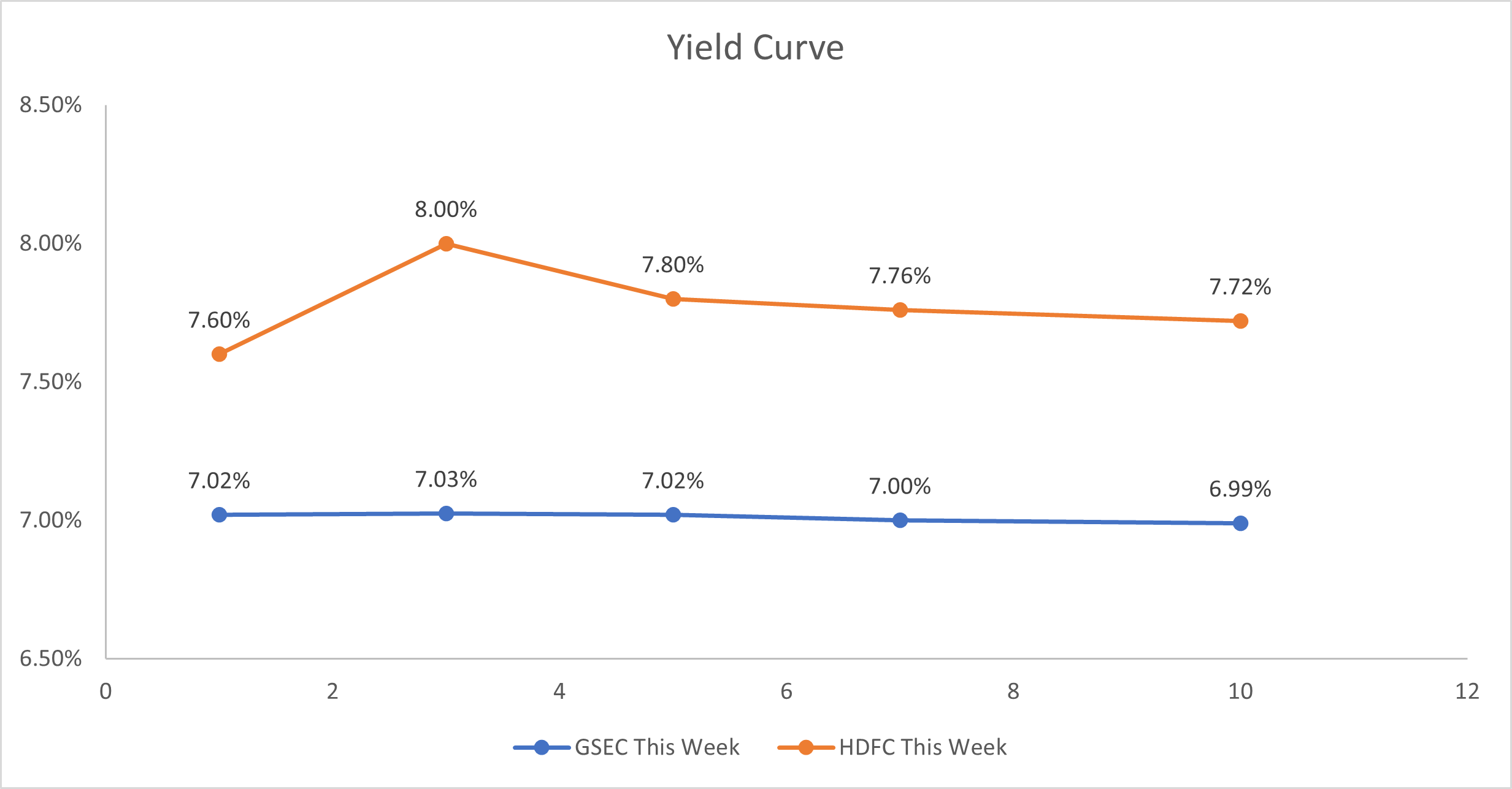

Yield Curve:

Most actively traded bonds in the Standard Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE261F08EI9 | 7.70 NABARD 30SEP27 | 1027 | 7.72 |

| INE115A07PD7 | 6.40 LICHSGFIN 24JAN25 | 960 | 7.75 |

| INE756I07ES3 | 8.1965 HDB 30MAY25 | 760 | 8.30 |

| INE261F08EA6 | 7.50 NABARD 31AUG26 | 730 | 7.74 |

Most actively traded bonds in the Odd Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE572J07703 | 9.81 SPANDANA 02APR26 | 50.3 | 11.63 |

| INE918K07PF8 | 0% NUVAMAWEALTH 13JUL27 | 20.86 | 9.57 |

| INE06E507165 | 10.57 HELLAINFRA 23NOV25 | 20.27 | 11.55 |

| INE540P08028 | 9.70 UPPCL 04JUL31 | 19.98 | 8.89 |

Maturity-based traded volume:

| Maturity | Volume(in Cr) |

|---|---|

| 1Y | 12000 |

| 3Y | 6481 |

| 5Y | 2713 |

| 7Y | 860 |

| 10Y | 2214 |

Outlier Trades:

| ISIN | Security Name | YTM May 30(%) |

YTM May 29(%) |

Deviation(%) |

|---|---|---|---|---|

| INE06E507207 | 10.97 HELLAINFRA 05OCT25 | 11.38 | 13.7 | -2.32 |

| INE998Y07147 | 11.65 BERARFINLTD 22APR26 | 12.5 | 11.5 | 1.00 |

| INE157D07EF2 | 10.15 CCSPL 12JUL25 | 11.35 | 11.00 | 0.35 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in