Weekly Newsletter - 3rd May 2024

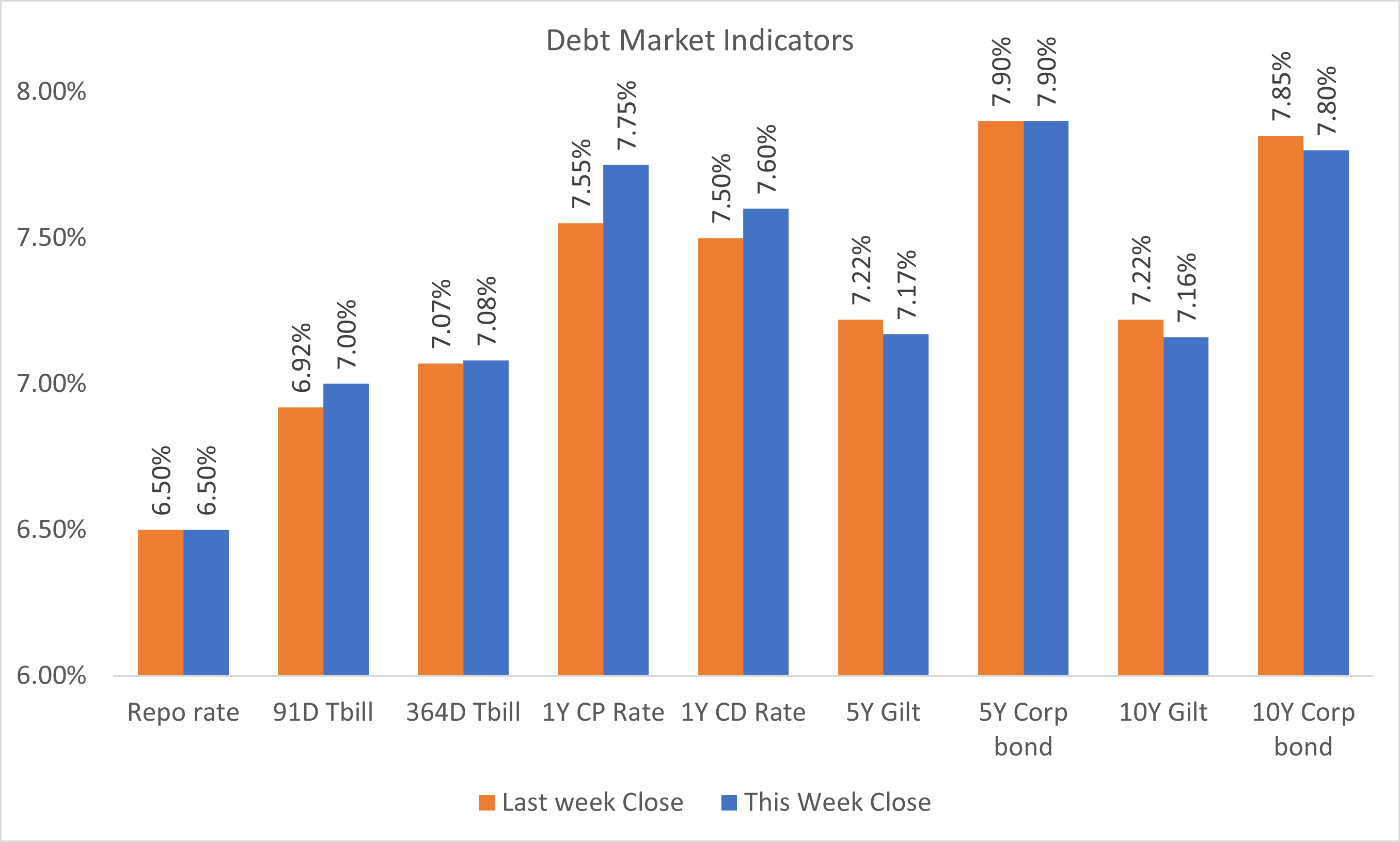

The Indian 10Y government bond is respecting the trading range of 7.15% to 7.25%. With the Fed reserve outcome having little impact and Brent crude trading below $85 a barrel, there was buying activity observed at 7.23% for the Indian 10Y bond. Market observers will closely watch to see if the current level of 7.16% holds or if there will be another round of selling. Participants in the market anticipate that unless there's a clear break below the lower end of the trading range, the Indian 10Y bond will continue to fluctuate between 7.15% and 7.25%.

Indian Debt

- The interbank call money rate ended at 6.50%.

- Indian 10Y bond yield was supported by the falling US 10Y and decreasing Brent prices.

- The yield of the 10-year benchmark 7.18% 2033 bond ended at 7.16%.

Market Trends

- Indian rupee remained flat against the US dollar.

- The US 10-year Treasury note has descended to 4.58% from its recent peak at 4.70%. The Fed chairman's emphasis on abstaining from rate hikes and future policy decisions being contingent on inflation data indicates that the 4.70% level on the US 10-year Treasury note may have been a temporary peak.

- Brent crude settled around $84 per barrel amid diminishing concerns regarding a broader conflict in the Middle East, coupled with an increase in US crude inventories and rising uncertainty regarding the demand outlook, all of which exerted pressure on oil prices.

General News

- The US Federal Reserve maintained interest rates at current levels and indicated a continued inclination towards potential future cuts in borrowing costs. However, it raised concerns about recent disappointing inflation figures.

- The US non-farm payroll and unemployment data are scheduled for release on May 3, 2024.

| Global Markets | Close | Last week close |

|---|---|---|

| US 10Y | 4.58 | 4.55 |

| USD/INR | 83.38 | 83.34 |

| Brent | 84.50 | 89.40 |

Primary Issues

| Issuer Name | Ratings | Tenor | Issue Size + Green Shoe (in crs) |

Open Date | Exchange |

|---|---|---|---|---|---|

| Onesource Spec | CARE BBB+ | 52 months | 200+0 | 03-May-24 | BSE |

Insights from our Team Experts

Bonds with the highest number of quotes on our Platform:

| ISIN | Security Name | Total Bids | Total Offers |

|---|---|---|---|

| INE342T07429 | 10.25 NAVI FINSERV 31DEC26 | 11 | 13 |

| INE658F08094 | 8.95 KIIFB 22DEC31 | 6 | 7 |

| INE146O08233 | 9.45 HINDUJA LEYLAND 23AUG33 | 6 | 14 |

| INE342T07460 | 10.65 NAVI FINSERV 13MAR27 | 5 | 17 |

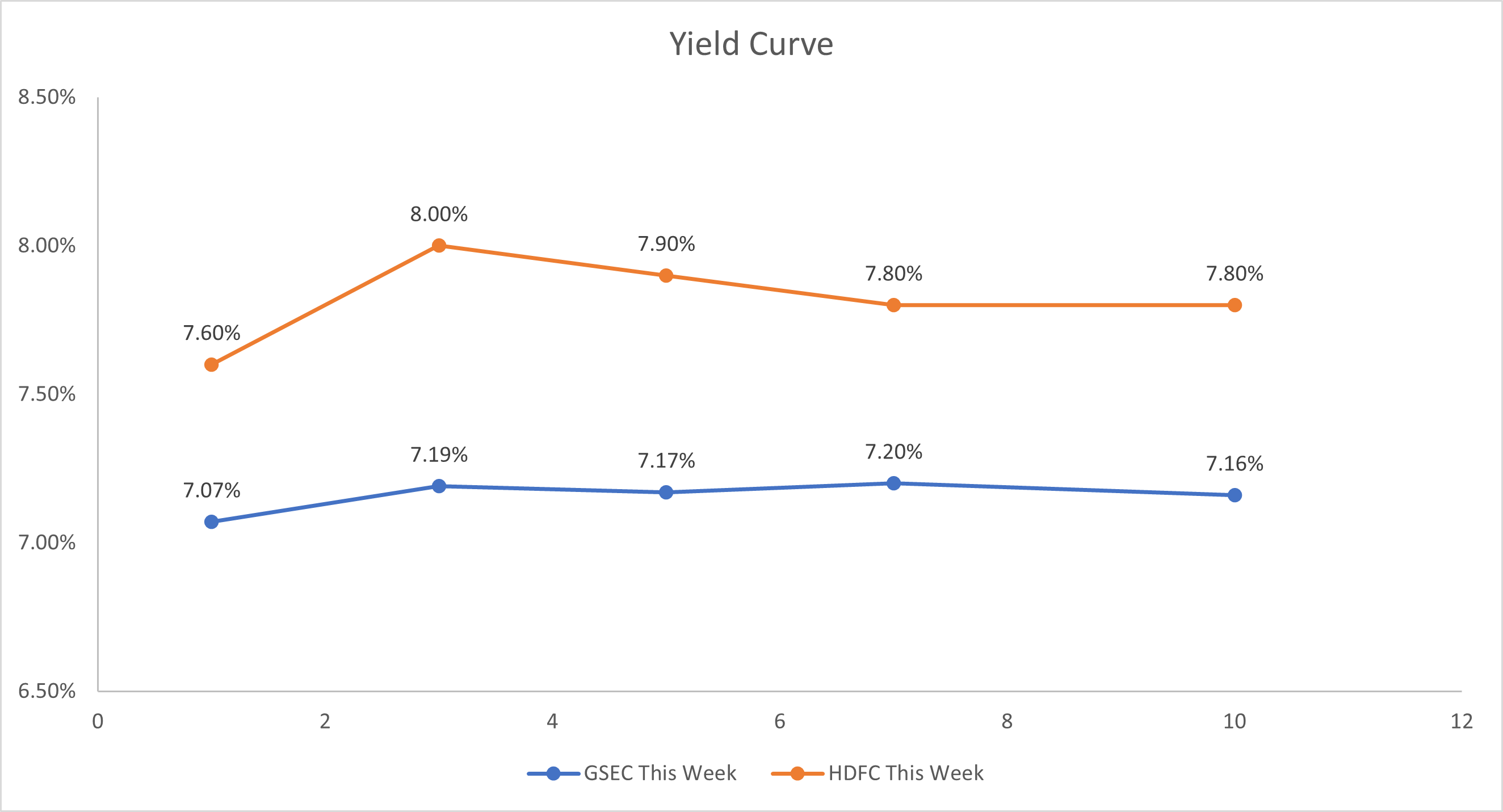

Yield Curve:

Most actively traded bonds in the Standard Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE557F08FX6 | 7.51 NATIHBK 04APR31 | 710 | 7.51 |

| INE261F08BK1 | 7.69 NABARD 29MAY24 | 380 | 7.14 |

| INE296A07SJ6 | 8.00 BAJAJ FINANCE 27FEB26 | 300 | 8.10 |

| INE040A08922 | 7.80 HDFC BANK 02JUN25 | 250 | 8.06 |

Most actively traded bonds in the Odd Lot Market:

| ISIN | Security Name | Volume (Cr) | Avg. Yield (%) |

|---|---|---|---|

| INE721A07RI7 | 1.00 SHRIRAMFIN 21APR25 | 26 | 8.48 |

| INE296Q07050 | 13.15 MONEYBOXX FIN 21FEB26 | 17 | 11.83 |

| INE101Q07AQ7 | 10.00 MUTHOOTU MINI 25APR27 | 12.25 | 10.82 |

| INE342T07460 | 10.65 NAVIFIN 13MAR27 | 11.83 | 11.16 |

Maturity-based traded volume:

| Maturity | Volume(in Cr) |

|---|---|

| 1Y | 2095 |

| 3Y | 910 |

| 5Y | 904 |

| 7Y | 928 |

| 10Y | 705 |

Outlier Trades:

| ISIN | Security Name | YTM May 2(%) | YTM Apr 30(%) | Deviation(%) |

|---|---|---|---|---|

| INE08XP07191 | 13.00 AKARA 09APR25 | 14.70 | 13.65 | 1.06 |

| INE06E507199 | 10.47 HELLA INFRA 26SEP25 | 16.55 | 15.62 | 0.93 |

| INE0M2307040 | 9.62 AP BEV 29MAY26 | 9.4 | 8.9 | 0.5 |

For any inquiries or assistance related to market data, please reach out to us at support@harmoney.in